When thinking about PPSA issues it will be useful to refer to examples and diagrams instead of just thinking in words alone.

The examples used in this book are all based upon diagram 1, the basic priority diagram shown above and introduced at paragraph 3.1.4 of Chapter 3 (Terminology).

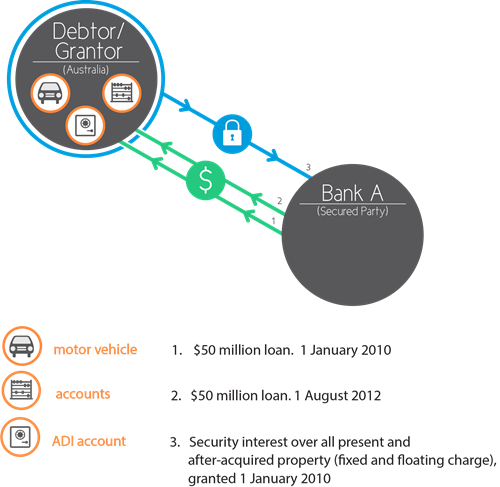

To explain the transactions in the basic PPS priority diagram:

(a) The debtor/grantor "D" enters into a loan agreement with the secured party Bank A.

-

- The loan agreement provides for a loan facility that permits two drawdowns.

- The first drawdown of $50 million dollars is made on 1 January 2010, before commencement of the PPSA.

- The second drawdown of $50 million dollars is made by D on 1 August 2012, after commencement of the PPSA.

- The loans are indicated on the diagram in green, by arrows leading from Bank A to D;

(b) D grants a fixed and floating charge (all-assets security interest) to Bank A at the inception of the loan agreement on 1 January 2010.

-

- This security interest is indicated on the diagram in blue, by arrows leading from D to Bank A.

- The blue line that encircles the entirety of D indicates that the fixed and floating charge covers all of D's assets;

(c) D's assets are shown in orange. D owns a motor vehicle, accounts (receivables) and an ADI account (bank account).

The basic PPS priority diagram is intended to bring out what are likely to be the three major issues under the PPSA, namely:

-

first, spot all security interests: spotting all the transactions that will be regulated as security interests under the PPSA; and

-

second, resolve priority contests: resolving priority contests between competing security interests in the same collateral.

As we shall see, determining the priority of security interests is very much the end-game because priority is often the solution in itself, or a means to a solution to many PPSA issues. Priority is key; and

- third, following value upon disposals of collateral: determining whether:

-

- security interests are extinguished upon sales or leases of collateral to others, and

so whether buyers and lessees of collateral take the collateral free from, or subject to, a security interest; and - security interests have recourse to proceeds generated from disposals of original collateral, which is likely if they attach and are perfected against both the original collateral and proceeds generated from it.

- security interests are extinguished upon sales or leases of collateral to others, and